The 1040-SR Form for 2022: All You Need to Know

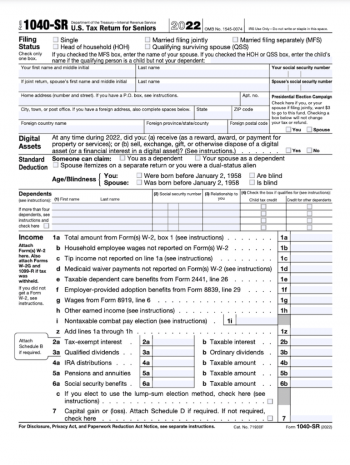

The tax jungle is often challenging to navigate. When you're a retired senior citizen, knowing which tax form to file and comprehending its regulations is imperative. The federal tax form 1040-SR for 2022, optimized for seniors and retired citizens, offers a simplified wage and benefits reporting version.

The 1040-SR Tax Return Form Key Features

Designed specifically for seniors above 65, the 2022 federal income tax form 1040-SR makes reporting income from social security benefits, investments, and pensions straightforward. It functions similarly to the classic Form 1040 but has a larger print to enhance readability and a chart for calculating standard deductions, making it easier for our seasoned citizens.

Form 1040-SR & Interesting Cases

- If you're a retiree who has just opted to receive social security benefits while maintaining income from part-time employment, maintaining the federal form 1040-SR for 2022 is critical. This revised form allows you to disclose all revenue streams accurately and ensure a legally compliant tax filing.

- You may also need to use form 1040-SR if you're a senior who owns properties and earns rental income. The form permits easy reporting of all real estate revenues alongside other income streams.

- For seniors receiving pension distributions alongside other income sources, the 1040-SR will allow ease of clearing dues and avoid the complexities often experienced with the standard 1040 form.

Error-Proofing Federal Form 1040-SR

Confusion and mistakes are common when dealing with tax forms. Should an error occur while submitting the federal 1040-SR form (2022), you can correct the mistake by submitting a corrected tax return using Form 1040X. Nobody deserves the dreaded 'error' status and the subsequent tax headaches.

Frequently Asked about Federal Form 1040-SR

- Can I use the printable tax form 1040-SR instead of the electronic version?

Yes, you can. The IRS accepts both versions, ensuring you can choose whatever suits your comfort. - Does every retiree qualify to use the 1040-SR?

To use form 1040-SR, taxpayers must be aged 65 years or older by the end of the tax year in question. - How should I file taxes if my spouse and I are of different ages?

As long as one spouse meets the 65-year-old requirement, you qualify to use Form 1040-SR in filing joint taxes.

To summarize, the printable federal tax form 1040-SR can ease seniors' usual annual return filing experiences. Understanding the Federal 1040-SR form (2022) and its nuances will go a long way in avoiding any troubles and ensuring all financial bases are legally covered.

Related Forms

-

![image]() 1040-SR IRS Form 1040-SR is a federal income tax return introduced by the Internal Revenue Service, specifically designed for seniors (taxpayers aged 65 or older). It became available in the tax year 2019 and remains updated for use in 2024. Compared to the basic 1040 copy, the 2023 federal tax form 1040-SR has a larger print and includes a standard deduction chart for quick reference. It is designed to make the tax-filling process easier for seniors by encompassing the information that relates specific... Fill Now

1040-SR IRS Form 1040-SR is a federal income tax return introduced by the Internal Revenue Service, specifically designed for seniors (taxpayers aged 65 or older). It became available in the tax year 2019 and remains updated for use in 2024. Compared to the basic 1040 copy, the 2023 federal tax form 1040-SR has a larger print and includes a standard deduction chart for quick reference. It is designed to make the tax-filling process easier for seniors by encompassing the information that relates specific... Fill Now -

![image]() 1040SR Fillable Form for 2023 Do you know, dear reader, that as a senior citizen, you have your very own special income tax form created by the IRS? To make a long story short, the IRS Form 1040SR fillable is designed specifically for taxpayers aged 65 or older. You use this form just like the regular Form 1040, but it's simplified with larger print and fewer calculations. No more squinting at small numbers or big complicated equations. The IRS is making it less of a chore and more of an easy-to-follow process just for you. Now, let's discuss the characteristics of a fillable 1040-SR form. The Simplicity of the Fillable 1040-SR Form If only all forms could be so straightforward! It's the digital era, and doing things by hand is becoming a thing of the past. The fillable IRS Form 1040-SR streamlines your tax filing process effortlessly. You can fill it out online, either on the IRS' own website or through a third-party service authorized by the IRS, made with spaces to enter in all your data without needing a physical form. Next, let's explore some potential difficulties you might encounter. Possible Hurdles in Online Form 1040-SR Filing Although the process is simpler and streamlined, it doesn't mean you're not going to face some issues. Few things can be tricky! Rest assured, there's always a solution. Some of us might have concerns about data privacy while filling directly on the IRS platform or an external site. Don’t fret! The IRS and its authorized third-party services must provide industry-standard security protocols. But don't forget. You will need a stable internet connection and enough time to finish the form in one session. Making sure you have both will give you smooth sailing to submitting the IRS 1040-SR fillable form in no time. Tips for Filing 1040-SR Fillable Forms Successfully Here are a few strategies to ensure you handle your Harris form 1040SR without any headaches. No one likes the headache, right? Especially in tax season! First off, gather all your tax documents before you start filling in your form. Trust me, it helps a lot. Secondly, while you fill in your form, checking it twice will bring you peace of mind. Accuracy is important. You don’t want to make an error and possibly have your form returned to edit and send in again. Lastly, do not wait until the last minute. I know there's always that temptation to procrastinate. But having enough time to double-check everything and finish at your pace will make filling less stressful. There you have it, quite simple, isn’t it? This article about the 1040SR fillable form for 2023 was of help. Good luck, my friends, with your tax season! Fill Now

1040SR Fillable Form for 2023 Do you know, dear reader, that as a senior citizen, you have your very own special income tax form created by the IRS? To make a long story short, the IRS Form 1040SR fillable is designed specifically for taxpayers aged 65 or older. You use this form just like the regular Form 1040, but it's simplified with larger print and fewer calculations. No more squinting at small numbers or big complicated equations. The IRS is making it less of a chore and more of an easy-to-follow process just for you. Now, let's discuss the characteristics of a fillable 1040-SR form. The Simplicity of the Fillable 1040-SR Form If only all forms could be so straightforward! It's the digital era, and doing things by hand is becoming a thing of the past. The fillable IRS Form 1040-SR streamlines your tax filing process effortlessly. You can fill it out online, either on the IRS' own website or through a third-party service authorized by the IRS, made with spaces to enter in all your data without needing a physical form. Next, let's explore some potential difficulties you might encounter. Possible Hurdles in Online Form 1040-SR Filing Although the process is simpler and streamlined, it doesn't mean you're not going to face some issues. Few things can be tricky! Rest assured, there's always a solution. Some of us might have concerns about data privacy while filling directly on the IRS platform or an external site. Don’t fret! The IRS and its authorized third-party services must provide industry-standard security protocols. But don't forget. You will need a stable internet connection and enough time to finish the form in one session. Making sure you have both will give you smooth sailing to submitting the IRS 1040-SR fillable form in no time. Tips for Filing 1040-SR Fillable Forms Successfully Here are a few strategies to ensure you handle your Harris form 1040SR without any headaches. No one likes the headache, right? Especially in tax season! First off, gather all your tax documents before you start filling in your form. Trust me, it helps a lot. Secondly, while you fill in your form, checking it twice will bring you peace of mind. Accuracy is important. You don’t want to make an error and possibly have your form returned to edit and send in again. Lastly, do not wait until the last minute. I know there's always that temptation to procrastinate. But having enough time to double-check everything and finish at your pace will make filling less stressful. There you have it, quite simple, isn’t it? This article about the 1040SR fillable form for 2023 was of help. Good luck, my friends, with your tax season! Fill Now -

![image]() 1040-SR Printable Form If you are above 65 and still have some source of income, then you, my friend, need to become acquainted with the 1040-SR tax form printable. This variant of the regular tax form takes into account seniors’ prerequisite for bigger, easier-to-read print and a chart for determining standard deductions. IRS 1040-SR printable form primarily focuses on various kinds of income, like wages, salaries, tips, interest, dividends, capital gains, IRA distributions, social security benefits, and so on. Once you get familiar with the layout, filling it will be a walk in the park. Printable 1040-SR Tax Form: Steps to Ensure Correct Fill-up To avoid legal repercussions owing to wrong data entry, you must fill up the form correctly. Here are a few points to help you do it with ease: Stick to the printable 1040-SR tax form's layout for easy navigation. Be truthful while specifying all income types, irrespective of whether they are taxable or not. Meticulously fill in personal information like name, social security number, and complete physical address. Consider picking up the online version to calculate totals, reducing manual error chances automatically. If you are unsure about any field, it is best to consult an experienced tax professional before incorrectly entering details. These are only to name a few. You’ll receive a comprehensive checklist in IRS Form 1040-SR for 2022 printable on the second page of the template. Submitting Form 1040-SR in 2023 Got the form filled meticulously? Great! Now it's time for the second-most detailing part of the tax paycheck filing process; submitting your tax form. The process, though seemingly straightforward, requires careful attention. You have to check the form, certify the particulars represent the legal truth, sign it exactly as on personal ID proofs, and then mail or submit it online to the Internal Revenue Service. You can find instructions on addressing the envelope correctly in the free printable 1040-SR form manual. The Federal Form 1040-SR Deadline Every tax-related task has one thing in common – a strict deadline. For the IRS Form 1040-SR, your form must hit the IRS's desk by the 15th of April of the following year. Failing to meet this deadline could mean incurring hefty penalties and fines. Hence remember to start early and ensure you are able to submit your completed form on or ahead! Treating tax filing seriously will help run your retirement period now and in the days to come smoothly. Fill Now

1040-SR Printable Form If you are above 65 and still have some source of income, then you, my friend, need to become acquainted with the 1040-SR tax form printable. This variant of the regular tax form takes into account seniors’ prerequisite for bigger, easier-to-read print and a chart for determining standard deductions. IRS 1040-SR printable form primarily focuses on various kinds of income, like wages, salaries, tips, interest, dividends, capital gains, IRA distributions, social security benefits, and so on. Once you get familiar with the layout, filling it will be a walk in the park. Printable 1040-SR Tax Form: Steps to Ensure Correct Fill-up To avoid legal repercussions owing to wrong data entry, you must fill up the form correctly. Here are a few points to help you do it with ease: Stick to the printable 1040-SR tax form's layout for easy navigation. Be truthful while specifying all income types, irrespective of whether they are taxable or not. Meticulously fill in personal information like name, social security number, and complete physical address. Consider picking up the online version to calculate totals, reducing manual error chances automatically. If you are unsure about any field, it is best to consult an experienced tax professional before incorrectly entering details. These are only to name a few. You’ll receive a comprehensive checklist in IRS Form 1040-SR for 2022 printable on the second page of the template. Submitting Form 1040-SR in 2023 Got the form filled meticulously? Great! Now it's time for the second-most detailing part of the tax paycheck filing process; submitting your tax form. The process, though seemingly straightforward, requires careful attention. You have to check the form, certify the particulars represent the legal truth, sign it exactly as on personal ID proofs, and then mail or submit it online to the Internal Revenue Service. You can find instructions on addressing the envelope correctly in the free printable 1040-SR form manual. The Federal Form 1040-SR Deadline Every tax-related task has one thing in common – a strict deadline. For the IRS Form 1040-SR, your form must hit the IRS's desk by the 15th of April of the following year. Failing to meet this deadline could mean incurring hefty penalties and fines. Hence remember to start early and ensure you are able to submit your completed form on or ahead! Treating tax filing seriously will help run your retirement period now and in the days to come smoothly. Fill Now -

![image]() 2023 1040-SR Tax Form Being on top of your taxes can often feel overwhelming, especially now that there's a new tax Form 1040-SR for retired taxpayers in the USA. Understanding and using this properly could save you much stress and extra money. Let's examine this new form in an amicable and easy-to-comprehend manner. The Genesis of Tax Form 1040-SR In an attempt to simplify an already complex taxation code, the U.S. Congress introduced tax form 1040-SR for seniors in 2020. This new version of the classic 1040 tax form is designed for individuals 65 and older who might require extra help filing their taxes. It bears similarities to the standard form, but what sets 1040-SR apart is its larger print and spotlight on income that seniors typically receive, like social security, investments, and retirement plans. What Sets the 1040-SR Tax Form Apart While the new return maintains much of the original 1040 layout, adjustments to the 1040SR 2023 tax form more precisely accommodate an older demographic's needs. These differently arranged line items assist seniors in locating and reporting monies from sources that the IRS considers taxable. Familiar sources of income for seniors include the following: pensions, annuities, social security benefits. Also, these changes ensure less squinting as the font size on the main form and supporting schedules is noticeably larger. Federal Tax Form 1040-SR: Who Can and Can't Use It Determining eligibility to use the tax form 1040SR for 2023 does warrant careful consideration. Yes, Uncle Sam declares that as long as you are 65 or older by the end of the tax year, you can use this form. Being retired is not a requirement. However, here's the catch - if you are planning to itemize your deductions, Form 1040-SR may not be suitable for you as it merely allows for standard deductions. Consult your tax professional if you're unsure whether this form is right for you. IRS Tax Form 1040-SR: Key Takeaways Staying savvy with taxes requires discovering and maximizing the merits distributed across these lines, just like understanding the rules of a puzzle game. Adopting this attitude could steer you toward a smoother tax season. Remember, the 2023 1040-SR tax form is more than just a document; it represents an essential part of managing your finances in the golden phase of life. Use the larger print for easier reading, take advantage of the more straightforward process, and embrace the tax form designed with seniors in mind. Fill Now

2023 1040-SR Tax Form Being on top of your taxes can often feel overwhelming, especially now that there's a new tax Form 1040-SR for retired taxpayers in the USA. Understanding and using this properly could save you much stress and extra money. Let's examine this new form in an amicable and easy-to-comprehend manner. The Genesis of Tax Form 1040-SR In an attempt to simplify an already complex taxation code, the U.S. Congress introduced tax form 1040-SR for seniors in 2020. This new version of the classic 1040 tax form is designed for individuals 65 and older who might require extra help filing their taxes. It bears similarities to the standard form, but what sets 1040-SR apart is its larger print and spotlight on income that seniors typically receive, like social security, investments, and retirement plans. What Sets the 1040-SR Tax Form Apart While the new return maintains much of the original 1040 layout, adjustments to the 1040SR 2023 tax form more precisely accommodate an older demographic's needs. These differently arranged line items assist seniors in locating and reporting monies from sources that the IRS considers taxable. Familiar sources of income for seniors include the following: pensions, annuities, social security benefits. Also, these changes ensure less squinting as the font size on the main form and supporting schedules is noticeably larger. Federal Tax Form 1040-SR: Who Can and Can't Use It Determining eligibility to use the tax form 1040SR for 2023 does warrant careful consideration. Yes, Uncle Sam declares that as long as you are 65 or older by the end of the tax year, you can use this form. Being retired is not a requirement. However, here's the catch - if you are planning to itemize your deductions, Form 1040-SR may not be suitable for you as it merely allows for standard deductions. Consult your tax professional if you're unsure whether this form is right for you. IRS Tax Form 1040-SR: Key Takeaways Staying savvy with taxes requires discovering and maximizing the merits distributed across these lines, just like understanding the rules of a puzzle game. Adopting this attitude could steer you toward a smoother tax season. Remember, the 2023 1040-SR tax form is more than just a document; it represents an essential part of managing your finances in the golden phase of life. Use the larger print for easier reading, take advantage of the more straightforward process, and embrace the tax form designed with seniors in mind. Fill Now -

![image]() 1040-SR Tax Form Instructions Zipping through your tax filing could be a challenging task. New opportunities like filing your tax return with the 1040-SR tax form instructions could come in handy for you. To put it in simple words, think of this form as your bucket. A bucket wherein you pile up your income details and calculate the tax you owe for a specific year. Federal Form 1040-SR & Eligibility Criteria Now, one significant detail about this bucket or the 1040-SR tax form is that it's not for everyone. Imagine a park filled with plenty of rides. Not all are suited for everyone, right? Similarly, IRS has delineated certain criteria for using this form. You should be at least 65 years old within the tax year. It's like certain rides which have an age limit. If you are married and filing jointly, at least one spouse should satisfy these age criteria. You can only include the income derived from certain resources - such as wages, salaries, social security benefits, pensions, and annuities. In simple words, you can only put certain things into your bucket. Exploring IRS Form 1040-SR with an Example Let's say, you are a retiree, your age is 67 years, and you are working part-time. Also, you are receiving a social security income. In such a scenario, you are eligible to use this form. The guidance provided by the 2022 Form 1040-SR instructions is for individuals like you. Looking after young ones, doing your part-time job, and now filing taxes couldn't have been easier! Instructions to Fix the 1040-SR Form Errors Imagine you're solving a puzzle but stumbling upon a few pieces. No problem! The IRS Form 1040-SR instructions have guidelines to help you through. But for now, let's look at some common pressure points and their solutions: Incorrect Form: if you realize the form isn't the correct one for you, you can cross-check the eligibility criteria once again.In case you're underage or your income sources are different, use Form 1040 or 1040A as required. Difficulty Adding Details: maybe, it's your part-time income or social security, and you're witnessing some difficulties while jotting your income.You can refer to the IRS 1040-SR instructions. All the IRS documentation provides enormous guidance on how to detail your income correctly. It can serve as a compass guiding you in parent-and-child terms. To conclude, the IRS Form 1040-SR instructions for 2022 assist and ensure you can file your tax returns correctly, just as easy as baking cookies with your grandkids! So, prepare for a smooth and stress-free tax filing process. Fill Now

1040-SR Tax Form Instructions Zipping through your tax filing could be a challenging task. New opportunities like filing your tax return with the 1040-SR tax form instructions could come in handy for you. To put it in simple words, think of this form as your bucket. A bucket wherein you pile up your income details and calculate the tax you owe for a specific year. Federal Form 1040-SR & Eligibility Criteria Now, one significant detail about this bucket or the 1040-SR tax form is that it's not for everyone. Imagine a park filled with plenty of rides. Not all are suited for everyone, right? Similarly, IRS has delineated certain criteria for using this form. You should be at least 65 years old within the tax year. It's like certain rides which have an age limit. If you are married and filing jointly, at least one spouse should satisfy these age criteria. You can only include the income derived from certain resources - such as wages, salaries, social security benefits, pensions, and annuities. In simple words, you can only put certain things into your bucket. Exploring IRS Form 1040-SR with an Example Let's say, you are a retiree, your age is 67 years, and you are working part-time. Also, you are receiving a social security income. In such a scenario, you are eligible to use this form. The guidance provided by the 2022 Form 1040-SR instructions is for individuals like you. Looking after young ones, doing your part-time job, and now filing taxes couldn't have been easier! Instructions to Fix the 1040-SR Form Errors Imagine you're solving a puzzle but stumbling upon a few pieces. No problem! The IRS Form 1040-SR instructions have guidelines to help you through. But for now, let's look at some common pressure points and their solutions: Incorrect Form: if you realize the form isn't the correct one for you, you can cross-check the eligibility criteria once again.In case you're underage or your income sources are different, use Form 1040 or 1040A as required. Difficulty Adding Details: maybe, it's your part-time income or social security, and you're witnessing some difficulties while jotting your income.You can refer to the IRS 1040-SR instructions. All the IRS documentation provides enormous guidance on how to detail your income correctly. It can serve as a compass guiding you in parent-and-child terms. To conclude, the IRS Form 1040-SR instructions for 2022 assist and ensure you can file your tax returns correctly, just as easy as baking cookies with your grandkids! So, prepare for a smooth and stress-free tax filing process. Fill Now