Form 1040-SR: Simplifying Tax Filing for Senior Citizens

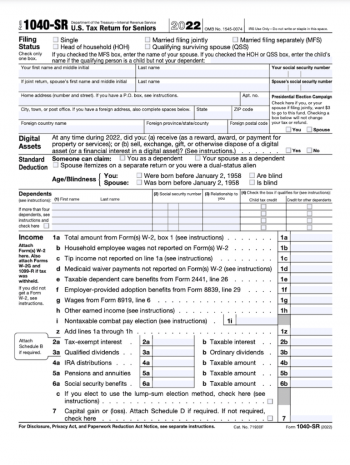

IRS Form 1040-SR is a federal income tax return introduced by the Internal Revenue Service, specifically designed for seniors (taxpayers aged 65 or older). It became available in the tax year 2019 and remains updated for use in 2024. Compared to the basic 1040 copy, the 2023 federal tax form 1040-SR has a larger print and includes a standard deduction chart for quick reference. It is designed to make the tax-filling process easier for seniors by encompassing the information that relates specifically to them.

Our website, 1040SR-form.net, is a valuable resource packed with comprehensive information and guidance to assist seniors in their tax filing process. The site provides clear, step-by-step IRS Form 1040-SR instructions for 2023 that take the guesswork out of filling out the template. Additionally, real-life examples are presented to give taxpayers a more concrete understanding of navigating their obligations accurately. The materials are designed to make the printable 1040-SR income tax form filing process less intimidating and to ensure proper completion of the document.

New Tax Form 1040-SR: Outlining the Essential Details

The 1040-SR form must be filed by U.S. taxpayers who are 65 or older at the end of the tax year. Ideally designed for seniors, the document features a larger print and a distinct standard deduction chart that may benefit this age group.

Consider Martha, a hypothetical retiree and full of vim at age 70. After working for years as a teacher, she embarked on freelance writing to keep her mind sharp and to benefit from needful supplementary income. In March 2023, she plans to print the IRS 1040-SR 2023 form from our website to settle her tax duties. Experiencing an impressive run with her writing, the combined income from her social security benefits, retirement funds, and freelancing necessitates filing her taxes using the IRS Form 1040-SR in 2023 to comply with the current law.

Consider Martha, a hypothetical retiree and full of vim at age 70. After working for years as a teacher, she embarked on freelance writing to keep her mind sharp and to benefit from needful supplementary income. In March 2023, she plans to print the IRS 1040-SR 2023 form from our website to settle her tax duties. Experiencing an impressive run with her writing, the combined income from her social security benefits, retirement funds, and freelancing necessitates filing her taxes using the IRS Form 1040-SR in 2023 to comply with the current law.

The user-friendly layout and added deductions mentioned in the printable 1040-SR tax form for 2023 enhance her experience while offering an accurate depiction of her taxable income and potential refunds. Thus, the requirements fit Martha’s demographic pool and efficiently manage her slightly complex income structure.

IRS Form 1040-SR Instructions for Year 2023

- Start by finding an IRS Form 1040-SR example on the website. It offers a perspective on how the completed template would look like and the information you'll need.

- Next, access the printable template for the IRS 1040-SR tax return form for 2023 that is needed for your filing. This could be downloaded for offline use or filled out online, depending on your preference.

- Make sure you prepare all data requested in the 1040-SR and fill the form with your Social Security Number, address, and filing status are both accurate and current. The section dedicated to income must reflect all your earnings during the filing year. This includes Social Security benefits, capital gains, dividends, as well as distributions from annuities or retirement plans.

- Regularly check the numbers you write down. Ensure they're both accurate and written in the appropriate fields. This carefulness helps avert possible discrepancies or errors.

- Finally, after filling out the deductions and credits page, totalize your amount owed or refund due, and sign and date your copy. After these steps, you're ready to submit your tax return.

File the 1040-SR Tax Return on Time

Filing your taxes is a key responsibility, and understanding the due date can help alleviate stress. For your yearly taxes, including the printable IRS tax form 1040-SR, the due date usually falls on April 15. Why April 15? It aligns with the standard calendar quarter following the close of the financial year on December 31. Yet, what if you need extra time? The IRS allows you to apply for a six-month extension, giving you until October 15 to finalize and submit all details. If you're an older taxpayer, you might consider using the IRS Form 1040-SR to file online. Having an online submission option combines convenience with efficiency.

Form 1040-SR for 2023 & Potential IRS Penalties

- An accuracy-related penalty of 20% could dampen the taxpayers if an understatement of income tax by the taxpayer due to negligence or disregard of rules or regulations is reported.

- The provision for fraud penalties is intrinsic. Providing fake details on the IRS 1040-SR tax form printable could lead to penalization of up to 75% of the unreported income.

- If a taxpayer fails to timely file the 1040-SR form, a penalty of 5% of the unpaid taxes might be added for each month the tax return is late, up to a maximum of 25%.

- If taxpayers don’t pay enough through withholding or estimated tax payments, a penalty for underpayment might be applicable.

2023 Form 1040-SR: People Usually Ask

- What is the new tax form 1040-SR, and who can use it?This document is specifically designed for older taxpayers. This allows seniors, typically over the age of 65, to complete a more accessible and understandable tax return. It can be used by individuals or spouses filing jointly, with unique features like a larger font size and a standard deduction chart on the form itself.

- How do I fill out an IRS Form 1040SR fillable?Unlike the traditional template, the IRS form 1040SR fillable is user-friendly and offers a logical flow of sections and clear instructions. However, it's essential to accurately fill in your income capacities, applicable deductions, and credits and calculate the accurate amount of tax you owe or refund due.

- Can I download and print tax form 1040-SR from the IRS website?Yes, you can download and print tax form 1040-SR directly from our website. After printing, you can fill in the paper sample manually before mailing it to the IRS. Please double-check the information before submitting it to prevent errors.

- When will IRS Form 1040-SR 2023 printable version be available?The IRS makes accessible the new template in early January annually. It's essential to continually keep an eye out for updates on its availability, which can fluctuate depending on changes made each new tax year.

- Is there any difference in tax calculation between IRS 2023 Form 1040SR and the standard 1040 sample?No, using the 1040-SR copy doesn't alter your tax calculation compared to Form 1040. It presents a less complicated layout and design, making it easier for seniors to understand and complete their tax returns.

Federal Tax Form 1040-SR: Related Articles

-

![image]() 1040SR Fillable Form for 2023 Do you know, dear reader, that as a senior citizen, you have your very own special income tax form created by the IRS? To make a long story short, the IRS Form 1040SR fillable is designed specifically for taxpayers aged 65 or older. You use this form just like the regular Form 1040, but it's simplif... Fill Now

1040SR Fillable Form for 2023 Do you know, dear reader, that as a senior citizen, you have your very own special income tax form created by the IRS? To make a long story short, the IRS Form 1040SR fillable is designed specifically for taxpayers aged 65 or older. You use this form just like the regular Form 1040, but it's simplif... Fill Now -

![image]() 1040-SR Printable Form If you are above 65 and still have some source of income, then you, my friend, need to become acquainted with the 1040-SR tax form printable. This variant of the regular tax form takes into account seniors’ prerequisite for bigger, easier-to-read print and a chart for determining standard dedu... Fill Now

1040-SR Printable Form If you are above 65 and still have some source of income, then you, my friend, need to become acquainted with the 1040-SR tax form printable. This variant of the regular tax form takes into account seniors’ prerequisite for bigger, easier-to-read print and a chart for determining standard dedu... Fill Now -

![image]() 2023 1040-SR Tax Form Being on top of your taxes can often feel overwhelming, especially now that there's a new tax Form 1040-SR for retired taxpayers in the USA. Understanding and using this properly could save you much stress and extra money. Let's examine this new form in an amicable and easy-to-comprehend manner. Th... Fill Now

2023 1040-SR Tax Form Being on top of your taxes can often feel overwhelming, especially now that there's a new tax Form 1040-SR for retired taxpayers in the USA. Understanding and using this properly could save you much stress and extra money. Let's examine this new form in an amicable and easy-to-comprehend manner. Th... Fill Now -

![image]() 1040-SR Tax Form Instructions Zipping through your tax filing could be a challenging task. New opportunities like filing your tax return with the 1040-SR tax form instructions could come in handy for you. To put it in simple words, think of this form as your bucket. A bucket wherein you pile up your income details and calculate... Fill Now

1040-SR Tax Form Instructions Zipping through your tax filing could be a challenging task. New opportunities like filing your tax return with the 1040-SR tax form instructions could come in handy for you. To put it in simple words, think of this form as your bucket. A bucket wherein you pile up your income details and calculate... Fill Now